【波澜壮阔的币圈中,涌现出来很多的优秀人物。币圈名人堂,旨在记录过去的,当下的,叱咤币圈风云的英雄们,币圈之家还将与币友们一起见证未来更多的币圈英雄诞生,希望便有此刻看这篇文章的你,让我们共同期待!】

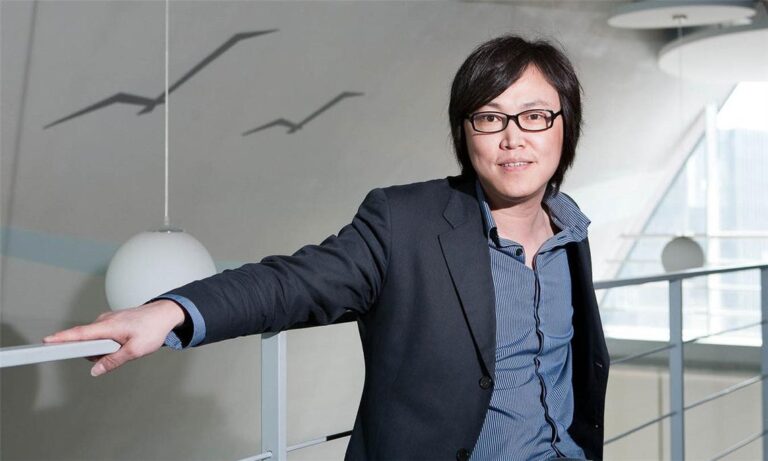

中本聪(英语:Satoshi Nakamoto),自称日裔美国人,日本媒体常译为中本哲史,加州科技大学物理系毕业,是一名物理学家、一位铁路模型收藏家,此人是比特币协议及其相关软件Bitcoin-Qt的创造者,但真实身份未知。

中本聪于2008年11月1号在互联网上一个讨论信息加密的邮件组中发表了一篇名为《比特币:一种点对点式的电子现金系统》(Bitcoin: A Peer-to-Peer Electronic Cash System)的论文,本文对建立一个非中心化的电子商务系统进行了详尽的阐述,并不要求建立在双方的信任基础上,描述了一种被他称为“比特币”的电子货币及其算法。

2009年1月3号,他为该系统建立了一个开放源代码项目 (open source project),推出了第一款应用于比特币运算的客户程序,并进行了第一次“采矿”,正式宣告了比特币的诞生,这也是比特币金融系统的正式开始。2010年12月5号,美国的外交电报被维基泄密,比特币社群要求维基解密接收比特币的捐赠,以突破财务封锁。中本聪强烈反对,他相信,比特币还处于萌芽阶段,经不起任何的冲突和争论。七天之后的12月12日,他在比特币论坛上发布了他的最后一篇帖子,提到了软件存在的问题,逐渐淡出并将项目移交给比特币社区的其他成员。中本聪据信持有约一百万个比特币。这些比特币在2013年底时的价值超过十亿美元。

从发表论文以来,中本聪的真实身份长期不为外界所知,维基解密创始人朱利安·阿桑奇(Julian Assange)宣称中本聪是一位密码朋克(Cypherpunk)。另外,有人称“中本聪是一名无政府主义者,他的初衷并不希望数字加密货币被某国政府或中央银行控制,而是希望其成为全球自由流动、不受政府监管和控制的货币。”

2022年3月,埃隆·马斯克在推特上爆料称,比特币发明人的化名Satoshi Nakamoto其实是由几个品牌名称拼凑出来的。他晒出韩国三星、日本东芝、日本中道、美国摩托罗拉的品牌标识,分别圈出其英文拼写SAMSUNG、TOSHIBA、NAKAMICHI、MOTOROLA中的SA、TOSHI和NAKA、MOTO,暗指Satoshi Nakamoto由它们组合而成。

不管中本聪是谁,毋庸置疑的是,他开启了一个波澜壮阔的加密货币时代,是当之无愧的加密世界创始者,创世之神。

附比特币中英对照版白皮书:

⽐特币:⼀种点对点的电⼦现⾦系统

作者:中本聪 [email protected] www.bitcoin.org 2008.10.31

中⽂翻译:李笑来 [email protected] 2018.10.31

Checkout Github Repo for this translation Abstract. A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they’ll generate the longest chain and outpace attackers. The network itself requires minimal structure. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

概要:⼀个纯粹的点对点版本的电⼦现⾦系统,将允许在线⽀付直接从⼀⽅发送到另⼀⽅,⽽⽆需通 过⾦融机构。数字签名虽然提供了部分解决⽅案,但,若是仍然需要被信任的第三⽅来防⽌双重⽀出 的话,那么电⼦⽀付的主要优势就被抵消了。我们提出⼀个⽅案,使⽤点对点⽹络去解决双重⽀出问 题。点对点⽹络将为每笔交易标记时间戳,⽅法是:把交易的散列数据录⼊⼀个不断延展的、以散列 为基础的⼯作证明链上,形成⼀个如⾮完全重做就不可能改变的记录。最⻓链,⼀⽅⾯⽤来证明已被 ⻅证的事件及其顺序,与此同时,也⽤来证明它来⾃于最⼤的 CPU 算⼒池。只要绝⼤多数 CPU 算⼒ 被良性节点控制 —— 即,它们不与那些尝试攻击⽹络的节点合作 —— 那么,良性节点将会⽣成最⻓ 链,并且在速度上超过攻击者。这个⽹络本身需要最⼩化的结构。信息将以最⼤努⼒为基本去传播, 节点来去⾃由;但,加⼊之时总是需要接受最⻓的⼯作证明链作为它们未参与期间所发⽣之⼀切的证 明。 1. 简介 (Introduction) Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely nonreversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for non-reversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party. 互联⽹商业⼏乎完全依赖⾦融机构作为可信第三⽅去处理电⼦⽀付。虽然针对⼤多数交易来说,这个系统还 算不错,但,它仍然被基于信任的模型所固有的缺陷所拖累。完全不可逆转的交易实际上并不可能,因为⾦ 融机构不能避免仲裁争议。仲裁成本增加了交易成本,进⽽限制了最⼩可能交易的规模,且⼲脆阻⽌了很多 ⼩额⽀付交易。除此之外,还有更⼤的成本:系统⽆法为那些不可逆的服务提供不可逆的⽀付。逆转的可能 性,造成了对于信任的需求⽆所不在。商家必须提防着他们的顾客,麻烦顾客提供若⾮如此(如若信任)就 并不必要的更多信息。⼀定⽐例的欺诈,被认为是不可避免的。这些成本和⽀付不确定性,虽然在⼈与⼈之 间直接使⽤物理货币⽀付的时候是可以避免的;但,没有任何⼀个机制能在双⽅在其中⼀⽅不被信任的情况 下通过沟通渠道进⾏⽀付。 What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers. In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions. The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes. 我们真正需要的是⼀种基于加密证明⽽⾮基于信任的电⼦⽀付系统,允许任意双⽅在不需要信任第三⽅的情 况下直接交易。算⼒保障的不可逆转交易能帮助卖家不被欺诈,⽽保护买家的⽇常担保机制也很容易实现。 在本论⽂中,我们将提出⼀种针对双重⽀出的解决⽅案,使⽤点对点的、分布式的时间戳服务器去⽣成基于 算⼒的证明,按照时间顺序记录每条交易。此系统是安全的,只要诚实节点总体上相对于相互合作的攻击者 掌握更多的 CPU 算⼒。 2. 交易 (Transactions) We define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. A payee can verify the signatures to verify the chain of ownership. 我们将⼀枚电⼦硬币定义为⼀个数字签名链。⼀位所有者将⼀枚硬币交给另⼀个⼈的时候,要通过在这个数 字签名链的末尾附加上以下数字签名:上⼀笔交易的哈希(hash,⾳译,亦翻译为“散列值”),以及新所有 者的公钥。收款⼈可以通过验证签名去验证数字签名链的所属权。 交易 所有者 1 的 公钥 所有者 0 的 签名 哈希 所有者 3 的 私钥 交易 所有者 3 的 公钥 所有者 2 的 签名 哈希 交易 所有者 1 的 公钥 所有者 0 的 签名 哈希 所有者 2 的 私钥 交易 所有者 2 的 公钥 所有者 1 的 签名 哈希 确认 签署 交易 所有者 1 的 公钥 所有者 0 的 签名 哈希 所有者 1 的 私钥 交易 所有者 1 的 公钥 所有者 0 的 签名 哈希 确认 签署 The problem of course is the payee can’t verify that one of the owners did not double-spend the coin. A common solution is to introduce a trusted central authority, or mint, that checks every transaction for double spending. After each transaction, the coin must be returned to the mint to issue a new coin, and only coins issued directly from the mint are trusted not to be double-spent. The problem with this solution is that the fate of the entire money system depends on the company running the mint, with every transaction having to go through them, just like a bank. 这个路径的问题在于收款⼈⽆法验证曾经的所有者之中没有⼈双重⽀付过。常⻅的解决⽅案是引⼊⼀个可信 的中⼼化权威⽅,或称“铸币⼚”,让它去检查每⼀笔交易是否存在双重⽀付。每⼀次发⽣交易之后,硬币必 须返回到铸币⼚,铸币⼚再发⾏⼀枚新的硬币。进⽽,只有铸币⼚直接发⾏的硬币才是可信的、未被双重⽀ 付过的。这个解决⽅案的问题在于,整个货币系统的命运被拴在运营铸币⼚的那个公司(就好像银⾏那样) 身上,每⼀笔交易必须通过它。 We need a way for the payee to know that the previous owners did not sign any earlier transactions. For our purposes, the earliest transaction is the one that counts, so we don’t care about later attempts to double-spend. The only way to confirm the absence of a transaction is to be aware of all transactions. In the mint based model, the mint was aware of all transactions and decided which arrived first. To accomplish this without a trusted party, transactions must be publicly announced 1 , and we need a system for participants to agree on a single history of the order in which they were received. The payee needs proof that at the time of each transaction, the majority of nodes agreed it was the first received. 我们需要⼀种⽅式,可以让收款⼈确认之前的所有者并没有在任何之前的交易上签名。就我们的⽬的⽽⾔, 只有最早的交易是算数的,所以,我们并不关⼼其后的双重⽀付企图。确认⼀笔交易不存在的唯⼀⽅法是获 悉所有的交易。在铸币⼚模型之中,铸币⼚已然知悉所有的交易,并且能够确认这些交易的顺序。为了能在 没有“被信任的⼀⽅”参与的情况下完成以上任务,交易记录必须被公开宣布 1 ,进⽽我们需要⼀个系统能 让参与者们认同它们所接收到的同⼀个唯⼀的交易历史。收款⼈需要证明在每笔交易发⽣之时,⼤多数节点 能够认同它是第⼀个被接收的。 3. 时间戳服务器 (Timestamp Server) The solution we propose begins with a timestamp server. A timestamp server works by taking a hash of a block of items to be timestamped and widely publishing the hash, such as in a newspaper or Usenet post 2 3 4 5 . The timestamp proves that the data must have existed at the time, obviously, in order to get into the hash. Each timestamp includes the previous timestamp in its hash, forming a chain, with each additional timestamp reinforcing the ones before it. 本解决⽅案起步于⼀种时间戳服务器。时间戳服务器是这样⼯作的:为⼀组(block)记录(items)的哈希 打上时间戳,⽽后把哈希⼴播出去,就好像⼀份报纸所做的那样,或者像是在新闻组(Usenet)⾥的⼀个 帖⼦那样 2 3 4 5 。显然,时间戳能够证明那数据在那个时间点之前已然存在,否则那哈希也就⽆法 ⽣成。每个时间戳在其哈希中包含着之前的时间戳,因此构成了⼀个链;每⼀个新的时间戳被添加到之前的 时间戳之后。 区块 哈希 记录 记录 … 区块 哈希 记录 记录 … 4. ⼯作证明 (Proof-of-Work) To implement a distributed timestamp server on a peer-to-peer basis, we will need to use a proof-ofwork system similar to Adam Back’s Hashcash 6 , rather than newspaper or Usenet posts. The proofof-work involves scanning for a value that when hashed, such as with SHA-256, the hash begins with a number of zero bits. The average work required is exponential in the number of zero bits required and can be verified by executing a single hash. 为了实现⼀个基于点对点的分布式时间戳服务器,我们需要使⽤类似亚当·伯克的哈希现⾦ 6 那样的⼀个⼯ 作证明系统,⽽不是报纸或者新闻组帖⼦那样的东⻄。所谓的⼯作证明,就是去寻找⼀个数值;这个数值要 满⾜以下条件:为它提取散列数值之后 —— 例如使⽤ SHA-256 计算散列数值 —— 这个散列数值必须以⼀ 定数量的 0 开头。每增加⼀个 0 的要求,将使得⼯作量指数级增加,并且,这个⼯作量的验证却只需通过 计算⼀个哈希。 For our timestamp network, we implement the proof-of-work by incrementing a nonce in the block until a value is found that gives the block’s hash the required zero bits. Once the CPU effort has been expended to make it satisfy the proof-of-work, the block cannot be changed without redoing the work. As later blocks are chained after it, the work to change the block would include redoing all the blocks after it. 在我们的时间戳⽹络中,我们是这样实现⼯作证明的:不断在区块之中增加⼀个随机数(Nonce),直到⼀ 个满⾜条件的数值被找到;这个条件就是,这个区块的哈希以指定数量的 0 开头。⼀旦 CPU 的耗费算⼒所 获的的结果满⾜⼯作证明,那么这个区块将不再能被更改,除⾮重新完成之前的所有⼯作量。随着新的区块 不断被添加进来,改变当前区块即意味着说要重新完成所有其后区块的⼯作。 区块 前哈希 随机数 Tx Tx … 区块 前哈希 随机数 Tx Tx … The proof-of-work also solves the problem of determining representation in majority decision making. If the majority were based on one-IP-address-one-vote, it could be subverted by anyone able to allocate many IPs. Proof-of-work is essentially one-CPU-one-vote. The majority decision is represented by the longest chain, which has the greatest proof-of-work effort invested in it. If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest and outpace any competing chains. To modify a past block, an attacker would have to redo the proof-ofwork of the block and all blocks after it and then catch up with and surpass the work of the honest nodes. We will show later that the probability of a slower attacker catching up diminishes exponentially as subsequent blocks are added. ⼯作证明同时解决了如何决定谁能代表⼤多数做决定的问题。如果所谓的“⼤多数”是基于“⼀个IP地址⼀ 票”的⽅式决定的话,那么任何⼀个可以搞定很多 IP 地址的⼈就可以被认为是“⼤多数”。⼯作证明本质上来 看,是“⼀个CPU⼀票”。所谓的“⼤多数决定”是由最⻓链所代表的,因为被投⼊最多⼯作的链就是它。如果 ⼤多数 CPU 算⼒被诚实的节点所控制,那么诚实链成⻓最为迅速,其速度会远超其他竞争链。为了更改⼀ 个已经产⽣的区块,攻击者将不得不重新完成那个区块以及所有其后区块的的⼯作证明,⽽后还要追上并超 过诚实节点的⼯作。后⽂展示为什么⼀个被拖延了的攻击者能够追上的可能性将随着区块的不断增加⽽指数 级降低。 To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they’re generated too fast, the difficulty increases. 为了应对硬件算⼒综合的不断增加,以及随着时间推进可能产⽣的节点参与数量变化,⼯作证明难度由此决 定:基于平均每⼩时产⽣的区块数量的⼀个移动平均值。如果区块⽣成得过快,那么难度将会增加。 5. ⽹络 (Network) The steps to run the network are as follows: 1. New transactions are broadcast to all nodes. 2. Each node collects new transactions into a block. 3. Each node works on finding a difficult proof-of-work for its block. 4. When a node finds a proof-of-work, it broadcasts the block to all nodes. 5. Nodes accept the block only if all transactions in it are valid and not already spent. 6. Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash. 运⾏⽹络的步骤如下: 1. 所有新的交易向所有节点⼴播; 2. 每个节点将新交易打包到⼀个区块; 3. 每个节点开始为此区块找⼀个具备难度的⼯作证明; 4. 当某个区块找到其⼯作证明,它就要将此区块⼴播给所有节点; 5. 众多其他节点当且只当以下条件满⾜才会接受这个区块:其中所有的交易都是有效的,且未被双 重⽀付; 6. 众多节点向⽹络表示⾃⼰接受这个区块的⽅法是,在创建下⼀个区块的时候,把被接受区块的哈 希当作新区块之前的哈希。 Nodes always consider the longest chain to be the correct one and will keep working on extending it. If two nodes broadcast different versions of the next block simultaneously, some nodes may receive one or the other first. In that case, they work on the first one they received, but save the other branch in case it becomes longer. The tie will be broken when the next proof-of-work is found and one branch becomes longer; the nodes that were working on the other branch will then switch to the longer one. 节点始终认为最⻓链是正确的那个,且会不断向其添加新数据。若是有两个节点同时向⽹络⼴播了两个不同 版本的“下⼀个区块”,有些节点会先接收到其中⼀个,⽽另外⼀些节点会先接收到另外⼀个。这种情况下, 节点将在它们先接收到的那个区块上继续⼯作,但也会把另外⼀个分⽀保存下来,以防后者成为最⻓链。当 下⼀个⼯作证明被找到,⽽其中的⼀个分⽀成为更⻓的链之后,这个暂时的分歧会被打消,在另外⼀个分⽀ 上⼯作的节点们会切换到更⻓的链上。 New transaction broadcasts do not necessarily need to reach all nodes. As long as they reach many nodes, they will get into a block before long. Block broadcasts are also tolerant of dropped messages. If a node does not receive a block, it will request it when it receives the next block and realizes it missed one. 新的交易不⻅得⼀定要⼴播到达所有的节点。只要到达⾜够多的节点,那么没多久这些交易就会被打包进⼀ 个区块。区块⼴播也容许⼀些消息被丢弃。如果⼀个节点并未接收到某个区块,那么这个节点会在它接收到 下⼀个区块的时候意识到⾃⼰错失了之前的区块,因此会发出补充那个遗失区块的请求。 6. 奖励 (Incentive) By convention, the first transaction in a block is a special transaction that starts a new coin owned by the creator of the block. This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue them. The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended. 按照约定,每个区块的第⼀笔交易是⼀个特殊的交易,它会⽣成⼀枚新的硬币,所属权是这个区块的⽣成 者。这么做,使得节点⽀持⽹络有所奖励,也提供了⼀种将硬币发⾏到流通之中的⽅式 —— 在这个系统 中,反正也没有⼀个中⼼化的权威⽅去发⾏那些硬币。如此这般稳定地增加⼀定数量的新硬币进⼊流通,就 好像是⻩⾦开采者不断耗⽤他们的资源往流通之中增加⻩⾦⼀样。在我们的系统中,被耗⽤的资源是 CPU ⼯作时间和它们所⽤的电⼒。 The incentive can also be funded with transaction fees. If the output value of a transaction is less than its input value, the difference is a transaction fee that is added to the incentive value of the block containing the transaction. Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free. 奖励还可以来⾃交易费⽤。如果⼀笔交易的输出值⼩于它的输⼊值,那么其中的差额就是交易费;⽽该交易 费就是⽤来奖励节点把该交易打包进此区块的。⼀旦既定数量的硬币已经进⼊流通,那么奖励将全⾯交由交 易⼿续费来完成,且绝对不会有通货膨胀。 The incentive may help encourage nodes to stay honest. If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth. 奖励机制也可能会⿎励节点保持诚实。如果⼀个贪婪的攻击者能够⽹罗⽐所有诚实节点都更多的 CPU 算 ⼒,他必须做出⼀个选择:是⽤这些算⼒通过把⾃⼰花出去的钱偷回来去欺骗别⼈呢?还是⽤这些算⼒去⽣ 成新的硬币?他应该能够发现按照规则⾏事是更划算的,当前规则使得他能够获得⽐所有其他⼈加起来都更 多的硬币,这显然⽐暗中摧毁系统并使⾃⼰的财富化为虚⽆更划算。 7. 回收硬盘空间 (Reclaiming Disk Space) Once the latest transaction in a coin is buried under enough blocks, the spent transactions before it can be discarded to save disk space. To facilitate this without breaking the block’s hash, transactions are hashed in a Merkle Tree 2 5 7 , with only the root included in the block’s hash. Old blocks can then be compacted by stubbing off branches of the tree. The interior hashes do not need to be stored. 如果⼀枚硬币最近发⽣的交易发⽣在⾜够多的区块之前,那么,这笔交易之前该硬币的花销交易记录可以被 丢弃 —— ⽬的是为了节省磁盘空间。为了在不破坏该区块的哈希的前提下实现此功能,交易记录的哈希将 被纳⼊⼀个 Merkle 树 2 5 7 之中,⽽只有树根被纳⼊该区块的哈希之中。通过砍掉树枝⽅法,⽼区块即 可被压缩。内部的哈希并不需要被保存。 区块 区块头(区块哈希) 前哈希 随机数 根哈希 哈希01 哈希23 哈希0 哈希1 哈希2 哈希3 Tx0 Tx1 Tx2 Tx3 交易的哈希以 Merkle 树⽅式组织 区块 区块头(区块哈希) 前哈希 随机数 根哈希 哈希01 哈希23 哈希2 哈希3 Tx3 从区块⾥剪除 Tx0-2 之后 A block header with no transactions would be about 80 bytes. If we suppose blocks are generated every 10 minutes, 80 bytes * 6 * 24 * 365 = 4.2MB per year. With computer systems typically selling with 2GB of RAM as of 2008, and Moore’s Law predicting current growth of 1.2GB per year, storage should not be a problem even if the block headers must be kept in memory. ⼀个没有任何交易记录的区块头⼤约是 80 个字节。假设每⼗分钟产⽣⼀个区块,80 字节乘以 6 乘以 24 乘 以 365,等于每年 4.2M。截⽌ 2008 年,⼤多数在售的计算机配有 2GB 内存,⽽按照摩尔定律的预测,每 年会增加 1.2 GB,即便是区块头必须存储在内存之中也不会是什么问题。 8. 简化版⽀付确认 (Simplified Payment Verification) It is possible to verify payments without running a full network node. A user only needs to keep a copy of the block headers of the longest proof-of-work chain, which he can get by querying network nodes until he’s convinced he has the longest chain, and obtain the Merkle branch linking the transaction to the block it’s timestamped in. He can’t check the transaction for himself, but by linking it to a place in the chain, he can see that a network node has accepted it, and blocks added after it further confirm the network has accepted it. 即便不⽤运⾏⼀个完整⽹络节点也有可能确认⽀付。⽤户只需要有⼀份拥有⼯作证明的最⻓链的区块头拷⻉ —— 他可以通过查询在线节点确认⾃⼰拥有的确实来⾃最⻓链 —— ⽽后获取 Merkle 树的树枝节点,进⽽ 连接到这个区块被打上时间戳时的交易。⽤户并不能⾃⼰检查交易,但,通过连接到链上的某个地⽅,他可 以看到某个⽹络节点已经接受了这个交易,⽽此后加进来的区块进⼀步确认了⽹络已经接受了此笔交易。 区块头 前哈希 随机数 Merkle 树根 区块头 前哈希 随机数 Merkle 树根 哈希01 哈希23 哈希2 哈希3 Tx3 Tx3 的 Merkle 树枝 区块头 前哈希 随机数 Merkle 树根 As such, the verification is reliable as long as honest nodes control the network, but is more vulnerable if the network is overpowered by an attacker. While network nodes can verify transactions for themselves, the simplified method can be fooled by an attacker’s fabricated transactions for as long as the attacker can continue to overpower the network. One strategy to protect against this would be to accept alerts from network nodes when they detect an invalid block, prompting the user’s software to download the full block and alerted transactions to confirm the inconsistency. Businesses that receive frequent payments will probably still want to run their own nodes for more independent security and quicker verification. 只要诚实节点依然在掌控⽹络,如此这般,验证即为可靠的。然⽽,如果⽹络被攻击者所控制的时候,验证 就没那么可靠了。尽管⽹络节点可以⾃⼰验证交易记录,但是,只要攻击者能够继续控制⽹络的话,那么简 化版验证⽅式可能会被攻击者伪造的交易记录所欺骗。应对策略之⼀是,客户端软件要接受来⾃⽹络节点的 警告。当⽹络节点发现⽆效区块的时候,即发出警报,在⽤户的软件上弹出通知,告知⽤户下载完整区块, 警告⽤户确认交易⼀致性。那些有⾼频收付发⽣的商家应该仍然希望运⾏属于⾃⼰的完整节点,以此保证更 独⽴的安全性和更快的交易确认。 9. 价值的组合与分割 (Combining and Splitting Value) Although it would be possible to handle coins individually, it would be unwieldy to make a separate transaction for every cent in a transfer. To allow value to be split and combined, transactions contain multiple inputs and outputs. Normally there will be either a single input from a larger previous transaction or multiple inputs combining smaller amounts, and at most two outputs: one for the payment, and one returning the change, if any, back to the sender. 尽管逐个地处理硬币是可能的,但为每分钱设置⼀个单独的记录是很笨拙的。为了允许价值的分割与合并, 交易记录包含多个输⼊和输出。⼀般情况下,要么是⼀个单独的来⾃于⼀个相对⼤的之前的交易的输⼊,要 么是很多个输⼊来⾃于更⼩⾦额的组合;与此同时,最多有两个输出:⼀个是⽀付(指向收款⽅),如果必 要的话,另外⼀个是找零(指向发款⽅)。 交易 ⼊ 出 ⼊ … … It should be noted that fan-out, where a transaction depends on several transactions, and those transactions depend on many more, is not a problem here. There is never the need to extract a complete standalone copy of a transaction’s history. 值得注意的是,“扇出”在这⾥并不是问题 —— 所谓“扇出”,就是指⼀笔交易依赖于数笔交易,且这些交易⼜ 依赖于更多笔交易。从来就没有必要去提取任何⼀笔交易的完整独⽴的历史拷⻉。 10. 隐私 (Privacy) The traditional banking model achieves a level of privacy by limiting access to information to the parties involved and the trusted third party. The necessity to announce all transactions publicly precludes this method, but privacy can still be maintained by breaking the flow of information in another place: by keeping public keys anonymous. The public can see that someone is sending an amount to someone else, but without information linking the transaction to anyone. This is similar to the level of information released by stock exchanges, where the time and size of individual trades, the “tape”, is made public, but without telling who the parties were. 传统的银⾏模型通过限制他⼈获取交易者和可信第三⽅的信息⽽达成⼀定程度的隐私保护。出于对将所有交 易记录公开的需求否决了这种⽅法。但是,维持隐私可通过于另⼀处的切断信息流来实现——公钥匿名。公 众可以看到某某向某某转账了⼀定的⾦额,但是,没有任何信息指向某个确定的⼈。这种⽔平的信息发布有 点像股市交易,只有时间和各个交易的⾦额被公布,但是,没有⼈知道交易双⽅都是谁。 交易双⽅身份 传统隐私保护模式 交易 可信 第三⽅ 交易另⼀⽅ 公众 交易双⽅身份 交易 公众 新隐私保护模式 As an additional firewall, a new key pair should be used for each transaction to keep them from being linked to a common owner. Some linking is still unavoidable with multi-input transactions, which necessarily reveal that their inputs were owned by the same owner. The risk is that if the owner of a key is revealed, linking could reveal other transactions that belonged to the same owner. 还有另外⼀层防⽕墙。交易者应该针对每⼀笔交易启⽤⼀对新的公私钥,以便他⼈⽆法将这些交易追溯到同 ⼀个所有者身上。有些多输⼊的交易依然难免被追溯,因为那些输⼊必然会被识别出来⾃于同⼀个所有者。 危险在于,如果⼀个公钥的所有者被曝光之后,与之相关的所有其他交易都会被曝光。 11. 计算 (Calculations) We consider the scenario of an attacker trying to generate an alternate chain faster than the honest chain. Even if this is accomplished, it does not throw the system open to arbitrary changes, such as creating value out of thin air or taking money that never belonged to the attacker. Nodes are not going to accept an invalid transaction as payment, and honest nodes will never accept a block containing them. An attacker can only try to change one of his own transactions to take back money he recently spent. 假设⼀个场景,某个攻击者正在试图⽣成⼀个⽐诚实链更快的替代链。就算他成功了,也不能对系统做任意 的修改,即,他不可能凭空制造出价值,也⽆法获取从未属于他的钱。⽹络节点不会把⼀笔⽆效交易当作⽀ 付,⽽诚实节点也永远不会接受⼀个包含这种⽀付的区块。攻击者最多只能修改属于他⾃⼰的交易,进⽽试 图取回他已经花出去的钱。 The race between the honest chain and an attacker chain can be characterized as a Binomial Random Walk. The success event is the honest chain being extended by one block, increasing its lead by +1, and the failure event is the attacker’s chain being extended by one block, reducing the gap by -1. 诚实链和攻击者之间的竞争可以⽤⼆项式随机漫步来描述。成功事件是诚实链刚刚被添加了⼀个新的区块, 使得它的优势增加了 ;⽽失败事件是攻击者的链刚刚被增加了⼀个新的区块,使得诚实链的优势减少了 。 The probability of an attacker catching up from a given deficit is analogous to a Gambler’s Ruin problem. Suppose a gambler with unlimited credit starts at a deficit and plays potentially an infinite number of trials to try to reach breakeven. We can calculate the probability he ever reaches breakeven, or that an attacker ever catches up with the honest chain, as follows 8 : 攻击者能够从落后局⾯追平的概率类似于赌徒破产问题。假设,⼀个拿着⽆限筹码的赌徒,从亏空开始,允 许他赌⽆限次,⽬标是填补上已有的亏空。我们能算出他最终能填补亏空的概率,也就是攻击者能够赶上诚 实链的概率 8 ,如下: 诚 实 节 点 找 到 下 一 个 区 块 的 概 率 攻 击 者 找 到 下 一 个 区 块 的 概 率 攻 击 者 落 后 个 区 块 却 依 然 能 够 赶 上 的 概 率 Given our assumption that , the probability drops exponentially as the number of blocks the attacker has to catch up with increases. With the odds against him, if he doesn’t make a lucky lunge forward early on, his chances become vanishingly small as he falls further behind. 既然我们已经假定 , 既然攻击者需要赶超的区块数量越来越多,那么其成功概率就会指数级下降。于 赢⾯不利时,如果攻击者没有在起初就能幸运地向前猛跨⼀步,那么他的胜率将在他进⼀步落后的同时消弭 殆尽。 We now consider how long the recipient of a new transaction needs to wait before being sufficiently certain the sender can’t change the transaction. We assume the sender is an attacker who wants to make the recipient believe he paid him for a while, then switch it to pay back to himself after some time has passed. The receiver will be alerted when that happens, but the sender hopes it will be too late. 现在考虑⼀下⼀笔新交易的收款⼈需要等多久才能充分确定发款⼈不能更改这笔交易。我们假定发款⼈是个 攻击者,妄图让收款⼈在⼀段时间⾥相信他已经⽀付对付款项,随后将这笔钱再转回给⾃⼰。发⽣这种情况 时,收款⼈当然会收到警告,但发款⼈希望那时⽊已成⾈。 The receiver generates a new key pair and gives the public key to the sender shortly before signing. This prevents the sender from preparing a chain of blocks ahead of time by working on it continuously until he is lucky enough to get far enough ahead, then executing the transaction at that moment. Once the transaction is sent, the dishonest sender starts working in secret on a parallel chain containing an alternate version of his transaction. 收款⼈⽣成了⼀对新的公私钥,⽽后在签署之前不久将公钥告知发款⼈。这样可以防⽌⼀种情形:发款⼈提 前通过连续运算去准备⼀条链上的区块,并且只要有⾜够的运⽓就会⾜够领先,直到那时再执⾏交易。⼀旦 款项已被发出,那个不诚实的发款⼈开始秘密地在另⼀条平⾏链上开⼯,试图在其中加⼊⼀个反向版本的交 易。 The recipient waits until the transaction has been added to a block and blocks have been linked after it. He doesn’t know the exact amount of progress the attacker has made, but assuming the honest blocks took the average expected time per block, the attacker’s potential progress will be a Poisson distribution with expected value: 收款⼈等到此笔交易被打包进区块,并已经有 个区块随后被加⼊。他并不知道攻击者的⼯作进展究竟如 何,但是可以假定诚实区块在每个区块⽣成过程中耗费的平均时间;攻击者的潜在进展符合泊松分布,其期 望值为: To get the probability the attacker could still catch up now, we multiply the Poisson density for each amount of progress he could have made by the probability he could catch up from that point: 为了算出攻击者依然可以赶上的概率,我们要把攻击者需要追赶的区块数⽬的帕松分布概率密度,乘以在落 后该区块数⽬下能够追上来的概率: Rearranging to avoid summing the infinite tail of the distribution… 为了避免对密度分布的⽆穷级数求和重新整理… Converting to C code… 转换为 C 语⾔程序…… #include double AttackerSuccessProbability(double q, int z) { double p = 1.0 – q; double lambda = z * (q / p); double sum = 1.0; int i, k; for (k = 0; k <= z; k++) { double poisson = exp(-lambda); for (i = 1; i <= k; i++) poisson *= lambda / i; sum -= poisson * (1 – pow(q / p, z – k)); } return sum; Running some results, we can see the probability drop off exponentially with . 获取部分结果,我们可以看到概率随着 的增加指数级下降: Solving for P less than 0.1%… 若是 P ⼩于 0.1%…… 12. 结论 (Conclusion) } q=0.1 z=0 P=1.0000000 z=1 P=0.2045873 z=2 P=0.0509779 z=3 P=0.0131722 z=4 P=0.0034552 z=5 P=0.0009137 z=6 P=0.0002428 z=7 P=0.0000647 z=8 P=0.0000173 z=9 P=0.0000046 z=10 P=0.0000012 q=0.3 z=0 P=1.0000000 z=5 P=0.1773523 z=10 P=0.0416605 z=15 P=0.0101008 z=20 P=0.0024804 z=25 P=0.0006132 z=30 P=0.0001522 z=35 P=0.0000379 z=40 P=0.0000095 z=45 P=0.0000024 z=50 P=0.0000006 P < 0.001 q=0.10 z=5 q=0.15 z=8 q=0.20 z=11 q=0.25 z=15 q=0.30 z=24 q=0.35 z=41 q=0.40 z=89 q=0.45 z=340 1. b-money Dai Wei (1998-11-01) http://www.weidai.com/bmoney.txt ↩ ↩ 2. Design of a secure timestamping service with minimal trust requirements Henri Massias, Xavier Serret-Avila, Jean-Jacques Quisquater 20th Symposium on Information Theory in the Benelux (1999-05) http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.13.6228 ↩ ↩ ↩ ↩ 3. How to time-stamp a digital document Stuart Haber, W.Scott Stornetta Journal of Cryptology (1991) https://doi.org/cwwxd4 DOI: 10.1007/bf00196791 ↩ ↩ 4. Improving the Efficiency and Reliability of Digital Time-Stamping Dave Bayer, Stuart Haber, W. Scott Stornetta Sequences II (1993) https://doi .org/bn4rpx DOI: 10.1007/978-1-4613-9323-8_24 ↩ ↩ 5. Secure names for bit-strings Stuart Haber, W. Scott Stornetta Proceedings of the 4th ACM conference on Computer and communications security – CCS ’97(1997) https://doi.org/dtnrf6 DOI: 10.1145/266420.266430 ↩ ↩ ↩ ↩ 6. Hashcash – A Denial of Service Counter-Measure Adam Back (2002-08-01) http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.15.8 ↩ ↩ 7. Protocols for Public Key Cryptosystems Ralph C. Merkle 1980 IEEE Symposium on Security and Privacy (1980-04) https://doi.org/bmvbd6 DOI: 10.1109/sp.1980.10006 ↩ ↩ 8. An Introduction to Probability Theory and its Applications William Feller John Wiley & Sons (1957) https://archive.org/details/AnIntroductionT oProbabilityTheoryAndItsApplicationsVolume1 ↩ ↩

+ There are no comments

Add yours